I see more and more posts with people advocating Medicare for All or some other form of single payer healthcare system in the United States. It’s a grand idea, but it just won’t work. Let me explain why.

Let’s start with some core assumptions behind this debate.

- A single-payer system would make healthcare services available to all Americans on an equal basis with no “out of pocket” cost for services provided.

- A single-payer system would remove the need for private/commercial insurance coverage and the associated premiums and out of pocket costs.

- All medical services can and would be available through the single-payer system.

- Costs for a single-payer system could be covered by reducing current spending on other programs (i.e. defense) and/or by increasing taxes paid by high income/high net worth individuals.

- Systems similar to those in other developed countries could be used as a model for an effective system in the United States.

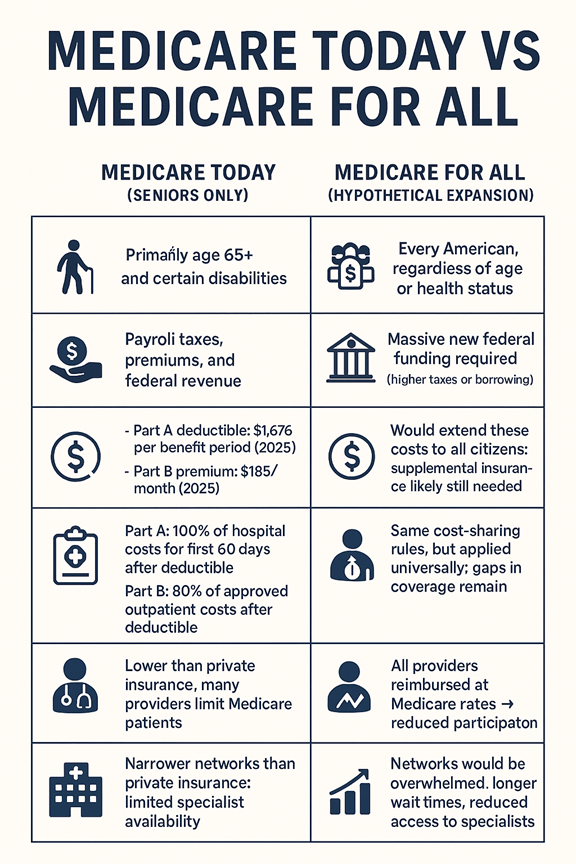

Let’s consider the idea of Medicare for all. In this model, Medicare would be expanded to include every American. When people suggest this, I think most don’t understand how Medicare actually works.

What is Medicare?: Medicare is the federal health insurance program primarily for people aged 65 and older, though it also covers younger individuals with certain disabilities or conditions like End-Stage Renal Disease. Medicare is divided into four parts:

• Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facilities, hospice, and some home health care.

• Part B (Medical Insurance): Covers outpatient care, doctors’ services, preventive services, and medical supplies.

• Part C (Medicare Advantage): Private plans approved by Medicare that bundle Parts A and B, often with additional benefits (i.e. Dental, Vision, Fitness).

• Part D (Prescription Drug Coverage): Helps cover the cost of medications.

Because original medicare does not cover all costs and does not include prescription drug coverage, the system has approved additional coverage options to help.

• Medicare Supplements (sometimes called Medigap) offer supplemental coverage that helps cover the cost of out of pocket expenses not covered my Part A and Part B.

So, Medicare operates as a partnership between the government and private insurance companies. But let’s keep looking to see what else we need to know.

Medicare is not free; Medicare is often misunderstood as “free healthcare,” but in reality, it is a cost-sharing system between the government and beneficiaries. enrollees pay premiums, deductibles, and coinsurance, and the program itself is funded by payroll taxes, premiums, and general federal revenue. To understand why expanding it to all Americans would be so expensive, it’s important to look at how much Medicare actually pays versus what patients still owe.

The Cost of Medicare for Current Seniors

Medicare already represents a significant financial burden:

Medicare Part A (Hospital Insurance)

• Coverage: Inpatient hospital stays, skilled nursing facilities, hospice, and some home health care.

• Costs Covered:

o After you pay the deductible ($1,676 in 2025), Medicare Part A covers 100% of hospital costs for days 1–60 of a benefit period.

o For days 61–90, patients pay a daily coinsurance ($419 in 2025).

o Beyond 90 days, patients can use lifetime reserve days (up to 60 total), but coinsurance rises to $838 per day.

• Bottom Line: Medicare Part A covers the bulk of short-term hospital stays, but extended stays quickly shift costs back to patients.

Medicare Part B (Medical Insurance)

• Part B: The standard monthly premium in 2025 is $185 (going up to $205 in 2026), with a deductible of $257 ($283 for 2026). Higher-income seniors pay more (sometimes a lot more. Do a quick Google search for IIRMA and check it out).

• Coverage: Outpatient care, doctor visits, preventive services, lab tests, imaging, durable medical equipment, and mental health services.

• Costs Covered:

o After the annual deductible, Medicare Part B pays 80% of approved medical costs.

o Patients are responsible for the remaining 20% coinsurance, and some providers may charge up to 15% more (known as “excess charges”) if they accept Medicare but not full assignment.

• Bottom Line: Medicare Part B is a cost-sharing plan, not full coverage. Patients must budget for 20% of nearly all outpatient services.

• Oh, and Medicare Part B does not cover an annual physical with no cost sharing like ACA or employer sponsored plans do.

Medicare Part D

• Part D: Prescription drug coverage also comes with premiums and income-related surcharges. Deductibles can vary by plan but could be as high as $615.00 in 2026 while premiums are projected to average $35.00 with some people paying significantly more. And then, members must still pay the co-pays for their specific medications up to the annual out of pocket limit of $2,100.

These costs are substantial even for the current senior population. Expanding Medicare to cover all Americans would multiply these expenses dramatically, requiring either massive tax increases or unsustainable federal borrowing. In fact, it is quite possible that implanting this system would actually force most American households to pay more out of pocket (in the form of taxes) than they currently pay through premiums and out-of-pocket costs under their private insurance plans.

So, ok it would be expensive. And maybe we could find away to reduce costs or increase taxes enough to pay for it, but what happens when we add everyone in the country to this single system? How does the system absorb all of those new members?

The Strain on Provider Networks

Medicare’s provider networks are already limited compared to private insurance. Studies show that Medicare Advantage enrollees often have access to only about half of the physicians in their area compared to traditional Medicare. Narrow networks and reimbursement challenges mean that many providers are reluctant to accept Medicare patients.

If Medicare for All were implemented many researchers predict:

• Provider shortages would worsen. Doctors and hospitals already face reimbursement rates lower than private insurance, which could discourage participation.

• Rural hospitals in the US are already under financial strain. Forcing them to accept all patients with current Medicare reimbursement rates could force many of them into bankruptcy. At the very least it would force providers to ration their time and create long waiting lists for non-urgent services.

• Wait times would increase. With tens of millions of new patients entering the system, the demand for services would far outpace supply.

• Quality of care could decline. Overburdened networks would struggle to maintain standards, especially for complex or specialized care.

Conclusion

Medicare for All may sound appealing as a universal solution, but the reality is stark:

• Medicare is already expensive for seniors and taxpayers.

• Expanding it nationwide would require enormous new funding.

• Provider networks would be overwhelmed, leading to longer waits and reduced access.

• We haven’t even considered the disruption that would be caused by the loss of 600,000 to 900,000 jobs in the private health insurance industry. None of the models account for that disruption.

For these reasons and more, I believe Medicare for All is not a practical or sustainable path for the U.S. healthcare system. Instead, reforms should focus on improving affordability and access without dismantling the balance between public and private coverage.